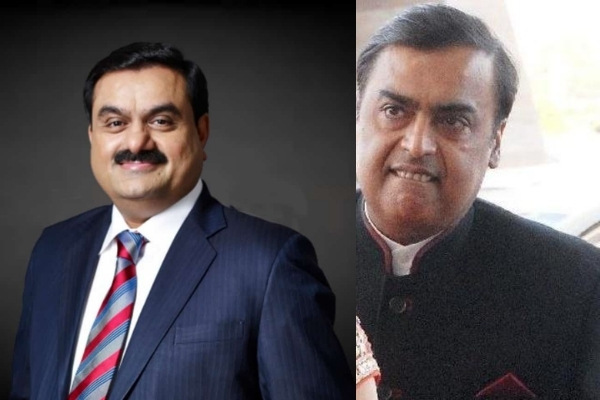

Gautam Adani, the CEO of Adani Group, has now become Asia’s richest billionaire. For the first time, Gautam Adani has achieved success. The interesting thing is that Gautam Adani accomplished this feat by defeating India’s Mukesh Ambani. Let us remind you that Mukesh Ambani was the top billionaire for a long time.

Today’s Value of Mukesh Ambani and Gautam Adani companies

According to ET Now, Gautam Adani has surpassed Mukesh Ambani to become Asia’s richest person based on group market capitalization. Let us remind you that Mukesh Ambani’s company, Reliance Industries, is publicly traded on the stock exchange. At the same time, six of Gautam Adani’s companies are publicly traded on the stock exchange.

The Bloomberg Billionaire Index, a wealth indexing website, has not updated its billionaire ranking. According to the website, Mukesh Ambani is still the richest billionaire in Asia. Mukesh Ambani’s net worth is $ 91 billion, making him the world’s 12th richest billionaire. At the same time, Gautam Adani’s fortune is valued at $ 88.8 billion. Gautam Adani is ranked 13th. The ranking could be updated on the website within the next 24 hours.

Why did Ambani’s fortune plummet?

Actually, Mukesh Ambani’s Reliance Industries stock is steadily declining. Reliance’s share price has dropped by 6% in the last three trading days. The stock has dropped as a result of the cancellation of the deal between Mukesh Ambani’s Reliance and Saudi Aramco. This transaction will now undergo a new round of churn. The cancellation of the deal after nearly three years of work has harmed investor sentiment. At the same time, the share price of some Adani Group companies has risen during this time period.

Read-Destiny Wagner of Belize was crowned Miss Earth 2021, Marisa Paige Butler Miss Earth Air

What about the company?

Reliance Industries share price is Rs 2350.90. (1.48 per cent loss). Simultaneously, the market capitalization exceeds 14 lakh 91 thousand crores. Simultaneously, the share price of Gautam Adani’s companies is as follows.

- Adani Enterprises: share price of Rs 1754.65 (up 2.76%), market capitalization of Rs 1,92,978 crore

- Adani Total: share price of Rs 1648.35 (down 1.58%), market capitalization of Rs 1,81,287 crore

- Adani Green Energy: the share price of Rs 1387.70 (down 1.37%), the market capitalization of Rs 2,17,038 crore

- Adani Port: share price of Rs-762.75 (up 4.59%), market capitalization of Rs 1,55,734 crore

- Adani Power: share price of Rs 105.95 (up 0.05%), market capitalization of Rs 40,864 crore

- Adani Transmission: share price of Rs 1924.45 (-0.85), market capitalization of Rs 2,11,652 crore